We have noticed that Italian inflation is 3%, at least according to ISTAT. Likewise, we have read the monthly report of the MISE/Italian Economic Ministry, where it is stated that main product cost sectors are rising from 5% to 50%; energy is expected to rise sharply in the next quarter as well. Understanding how the above values are compatible is hard, if not impossible (3% official statistical inflation, vs. up to 50%+ increase in prices of the main products in the basket/MISE Price Observatory).

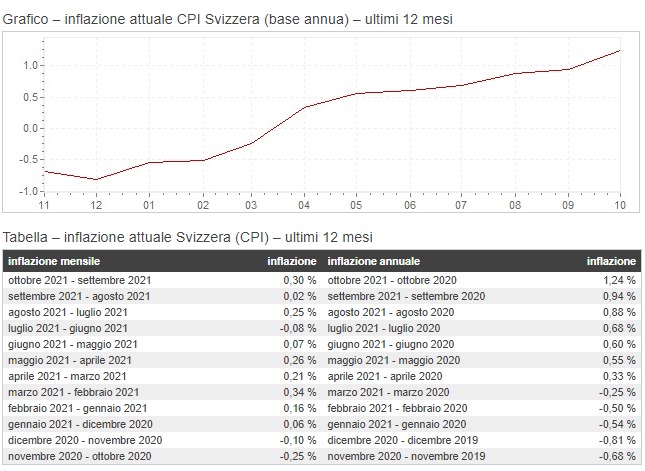

Similarly, we noticed that Switzerland shows an inflation rate in Swiss francs of 1.2% (Oct21). Clearly the Swiss franc, revaluing by 5-6% since last March (this morning: below 1.05 vs. Euro), has contributed to “take away” inflation from the Swiss Confederation, on the basis of local prices in Swiss francs. Therefore, ceteris paribus, European inflation, considering the representativeness of the Swiss one, should be about 5-6% higher. Or around 6%,.

Instead, the average inflation in EU figure is around 4%; meanwhile in Italy is at 3%. Something doesn’t add up, don’t you think?

*****

Just yesterday I had a public confirmation from a former employee of MISE, stating the following: “the prices recorded by that ministry cannot be different from those of ISTAT“, we were told: first good point I would say, it happened during a public event in Lugano ().

Perhaps the speaker, a former ECB reprersentative too, aside from current strong exogenous inflation from resources (huges damages expected if inflation is not lasting), might even be right. But if inflation is lasting, as almost all world experts agree about, including supranational bodies, what will happen?

Work in progress.

*****

Another interesting aspect emerged also publicly, in the style of “excusatio non petita, accusatio manifesta“: it has been pointed out, without being requested, that inflation cannot be falsified. E.g., that it is rigged! Obviously, the excuse is to say, “how th hell can all the world calculation institutes agree?” I have no answer to it, but I am reminded of the LIBOR scandal in which all the world banks on some extent agreed. And the central banks/regulators pretended not to see the scam until the very end (…).

The fact is that cost factors of households and businesses are rising WELL BEYOND the 3% indicated by the government. And in the presence of a MISE report – monthly price observatory – indicating that the main consumer goods have risen on average between 10 and 20%.

Encore, something doesn’t add up.

Interestingly, the excuses put forward by the above person, of ECB/MISE extraction, are very similar to mainstream Draghi boys in twitter. As if we did not know what is happening among the so-called regime supporters of a pro-Draghi mould (and perhaps with not too many hidden links with the pro-German and therefore pro-EU milieu of Milan, ed.). That is – the usual excuse -: “inflation rises only if incomes rise”, the usual mantra of central banks to deny the facts. Consumption? Not important, according to such people.

Nor is the health of businesses and households, economic health I mean. I’m just saying, “just wait”: if the night is cold and you deny it’s going below zero, if you are frozen to death in the morning then you cannot relate it to an accident occurred

*****

In any case, as an engineer, I allow myself to make a couple of simplified evaluations, in the context: first, inflation is known even to the stones that everywhere in the world is sweetened to help governments, making it appear lower than it is (…).

There are many methods, mainly centered on the timed cross reference between inflation and GDP deflator, but it is a too technical topic, I know (…). The fact remains that if, for example, it has been possible to, in a given country to halve the value of published statistical inflation with respect to real inflation, while in reality it is double or triple, it means that witrh a statistical inflation of e.g. 2%, real inflation would be 4 or 6% (all in all an easily concealed delta).

The problem arises if real inflation rises by 20%: in this situation the value of statistical inflation would be 7% or 10%. And in every case the difference would be noticeable.

Imagine, however, if – taking Italy in consideration – due to geopolitical constraints (e.g. Maastricht), it would not be possible to publish official (i.e. statistical) inflation above 4%, under penalty of collapse of the Italian economic system/bond market. At this point the Italians would be cd. screwed, as the solution would inevitably implement the Argentine solution with the “inflacion dibujada”, as it was endorsed at the time by the IMF; except to end up in a few years, two or three, with huge social unrest and a ethical crash with widespread impoverishment (…).

In fact, by communicating only 4% of official statistical inflation in the presence of, for example, a real inflation of 20%, italian businesses and families would/will be bankrupted by soaring costs, rising sharply; that is, without indexation of salaries and company margins.

The second consideration is that the facts tell us that the Central Banks are losing control not only of the situation, which has already happened for sometime, but also of the dialectic used to calm the masses, which is no longer credible, given that it is watertight for those who live in the real economy, see the examples above.

In other words, I believe we will soon be facing the “perfect storm”.

*****

All in all, thinking about it, a denied inflation when it is high – especially in the eurozone, a currency representative of an economic area that survives only if there is deflation, ed – in the medium term leads to a collapse in consumption with stress to companies, no longer able to reverse the higher costs of inflation (hidden) to consumers / customers. Therefore causing a crash of consumptions and business profits. That is, a reduction in economic transactions, with stress due to the absence of consumption leading progressively to economic depression.

Noting that this would anyway occur in the presence of high real inflation.

And voilà, without realizing it, we have reached the so-called “inflationary depression” stage, due to a currency that cannot be devalued independently because it is NOT sovereign (e.g. the euro); instead stagflation, more benign, relates to a standard sovereign currency.

Now you might well understand why I fear that the Central Banks are packing the real economic disaster of the last 200 years, kicking the can down the road.

All that remains is to wait for events. Noting that removing dissent through vaccines could also be a sophisticated way to save the political-financial class in power today (by pitchforks). Political class that has many responsibilities in the Italian economic debacle of the last 25 years.

Too bad that in the case to lose even and especially the existence would be you who read us…. hope not….

MD

Image: thanks to Gabriella Clare Marino, https://unsplash.com/photos/BtalpxzIiFs